Employee Provident Fund (EPF) is a fund to which both the employee and the company must contribute an equal amount of money that can be leveraged by the employee afterwards in times of need. The Employee Provident Fund Organisation of India (EPFO) manages the fund. Employees' Provident Fund (EPF) is a savings and retirement scheme for qualifying employees. Employees can rely on the fund's corpus when they retire. The money that goes into the EPF account of the workers and the money contributed by both the employee and the employer can be taken out at the time of retirement, together with interest. Both online and offline withdrawals of EPF funds are possible. So, let's dive deeper into understanding how to withdraw PF after retirement.

Did you know? According to the government rules, an employee contributes 12% of the basic pay plus Dearness Allowance, and the employer contributes 10-12% of your basic salary to the EPF account.

Applicability of the EPF (Employees' Provident Fund)

Let's look into the circumstances in which EPF is relevant:

Employees eligibility for EPF (Employees' Provident Fund):

1. Every salaried employee with a monthly income of less than ₹15,000 can have an EPF.

2. If the Assistant PF Commissioner and the employer agree, an employee with a monthly income greater than ₹15,000 (the current specified maximum) is entitled to join the EPF.

3. If an employee's salary is greater than ₹15,000 and they have never contributed to EPF, they might choose to opt out. This can be done by completing Form 11, an EPFO self-declaration form.

4. Even businesses with fewer than 20 employees may be eligible under specific circumstances.

5. EPF deductions are required by law for companies with 20 or more employees.

Documents needed to withdraw your PF

The following are the documents you'll need to withdraw money from your PF account:

- Two revenue stamps

- Form 19

- A blank and cancelled cheque with IFSC code and account number. Also, you should ensure that the cheque provided by you is a single account holder cheque.

- Identity proof

- Form 10 C and Form 10D

- Form 31

- Bank account statement

- Address proof

How can EPF be withdrawn?

EPF can be withdrawn entirely or partially.

Entire Withdrawal:

EPF can be completely withdrawn in any of the following situations:

• When a person retires;

• When someone has been out of work for longer than two months. To make a withdrawal, individuals must get an attestation from a gazetted officer.

Partial Withdrawal:

It is possible to withdraw a portion of your EPF balance only under limited situations.

- Reasons for withdrawal in detail: For medical reasons

Withdrawal limit:

- 6 times the monthly basic salary, or

- The total employee share plus interest

Also Read: PF Calculator - Calculate EPF, Employee's Provident Funds Online 2021-22

EPF Withdrawal Procedure

In general, you can do your EPF withdrawal by submitting one of the following forms:

1. Physical application

2. Online application

Physical Application:

For EPF withdrawal, download the new Composite Claim Form (Aadhaar or non-Aadhaar).

Form for a Composite Claim (Aadhaar)

1. If you have seeded your Aadhaar number and bank account details on the Universal Account Number (UAN) portal and your UAN is operational, use the Composite Claim Form (Aadhaar).

2. Fill out the form and submit it to the EPFO office in your jurisdiction without the employer's signature.

Composite Claim Form (Non-Aadhaar)

1. If your Aadhaar number isn't seeded on the UAN portal, you can utilise the Composite Claim Form (Non-Aadhaar).

2. Fill out the form and submit it to the EPFO office in your area, together with the employer's attestation.

How to Withdraw Money after retirement from an EPF Account Online?

Step 1: Navigate to the UAN Member e-Sewa portal- https://unifiedportal-mem.epfindia.gov.in/

Step 2: Enter your UAN, password, and the CAPTCHA. Now, select the Sign-in option.

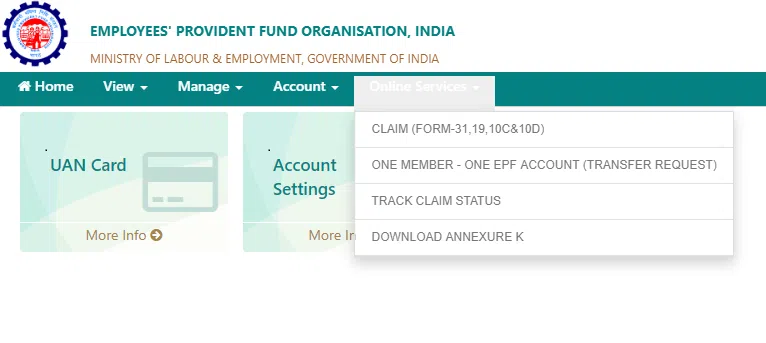

Step 3: Next, from the top menu, select Online Services.

Step 4: Finally, select the CLAIM option.

Step 5: You must double-check the information on the Online Claim form.

Step 6: After verification, submit your bank account number.

Step 7: Press the Verify button.

Step 8: On the certificate of the undertaking, click the yes button.

Step 9: The following step will ask you to proceed with the claim by clicking on the Proceed for Online Claim button.

Step 10: You must now indicate whether you request an advanced PF withdrawal on the claim form.

Step 11: Select the reason for withdrawal from the 'Purpose for which advance is requested' drop-down box.

Step 12: In the Employee Address column, enter the needed amount and your mailing address.

Step 13: Select the certificate and complete the form.

Step 14: You will then be asked to submit scanned documents for the purpose for which the claim form was filled out.

Every employee withdrawing EPF funds should know that their employer must accept their request before the withdrawal can be completed.

Also Read: EPF Withdrawal Procedure - How to Withdraw PF Online? Application, Status

Conclusion

Employees' Provident Fund is a saving and retirement fund for employees who meet certain criteria. When employees retire, they will be able to rely on this fund. Various documents are required to withdraw PF online which have been highlighted in this article. A proper procedure which is to be followed to withdraw PF after retirement has also been mentioned in a step-by-step process.

For the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting, follow Khatabook.