Khatabook app is an accounting app that can be downloaded on mobile devices which will make accounting easy. There is no need to hire an accountant when you have installed the Khatabook app (your intelligent digital accountant). With this app, it is possible to maintain a ledger account book in your pocket. Lend money to anyone and any amount; still, stop bothering about getting repaid as the Khatabook app will do the followup job. Keep reminding borrowers to repay the money but maintain a cordial relationship with them. Yes, using this app nothing is impossible in terms of maintaining an udhaar basic account.

Apart from offering the above benefits, there is another feature that adds value to the Khatabook app. Simply add bank account to the app and this feature of linking your bank account to the Khatabook app will offer an additional edge to take your business to the next level. Understand how it is achievable from this article.

Top 6 Reasons To Add Bank Account in Khatabook App

Receive payment

When it is said that the Khatabook app will help manage credit accounting, it is important to enter the details to this app. Imagine, if that also can be done automatically, nothing like that. Once you generate a Khatabook QR, your customers can make payment scanning this code with their smartphone camera. QR code will be generated and couriered to your physical address for free from Khatabook. For successfully generating QR code, linking a bank account with the Khatabook app is a must. Your bank details are verified and hence it becomes easy for customers to make a payment without carrying their credit or debit cards.

Remind payment

Upon receiving payment in your bank account directly that is linked with the Khatabook app there is no need to manually enter the details. This means the app will calculate credit and debit for each customer in your Khatabook account and it will also enable a reminder SMS feature to remind the borrowers about their sue payment. Further, if they also have tied up their bank account to the app, then within no time they can click the link that they received along with the SMS to make payment instantaneously.

Payment History

The hassle of knowing how much payment was cleared and what is pending with the customer is no more there. Payment history will list down all details for each customer individually. With this data, it is easy to collect the due amount from the borrower.

Auditing and Taxing purpose

Irrespective of the size of the business it is important to file income tax with the Government of India as a practice. This will provide better visibility and also small business owners can avail of all the benefits offered by the Indian government from time to time. For tax filing purposes all bills and transactions must be recorded. Using the Khatabook app and linking to a bank account, all transaction details can be pulled from the bank summary anytime. Thus there is no need to reach out to any auditor and filing tax requires no education.

One accounting book for multiple businesses

This is yet another advantage offered when you add bank account in Khatabook app. You can include different Khata accounts and still connect with one bank account. All the credit and debit will happen from one bank account but you can maintain an individual Khatabook for each business. However, the same customers can be part of more than one Khata account. This means you can segregate the len-den details of the same customer for different businesses.

Cost-effective

All the above-discussed benefits are offered by including bank details to the Khatabook account for absolutely free. Yes, there are no charges included to receive payment, send reminders, manage accounts, generate a report, and download them. Above all, the entire bank details are recorded for future reference and make your business legal as you can abide by the tax policy laid by the Indian government. No longer worry about investing in swipe machines and getting an internet connection for your shop. This feature requires a smartphone with data that is available with all the customers and hence sending and receiving payment can be done at no additional cost.

How to Add Bank Account in Khatabook App?

Having discussed these many benefits offered by adding a bank account to the Khatabook app you must know how to complete this process. It is a very simple process, and follow the steps given below to complete the same.

- Install the Khatabook app in your mobile device and confirm OTP received to authenticate the device.

- Select the language in which you would like to use the app.

- Include customers and add transactions

- From the dashboard click on More

- Click on Payment History or generate a QR code which will prompt you to Add bank account.

OR

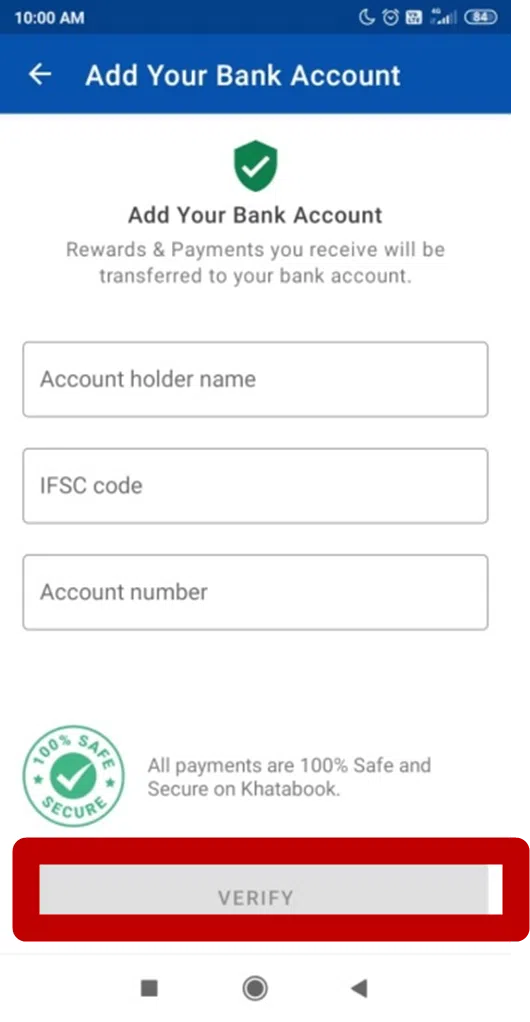

- Enter the following details and click verify

- Account holder name – Name as in the bank account

- IFSC code – This can be found in your cheque book

- Account Number - Which was given at the time of opening a bank account

- Khatabook will verify the bank details with the respective bank and then accept the credentials. You need to enter the PAN details for KYC completion.

- You will once again receive an OTP and when that is entered correctly your KYC verification is successful.

With this simple step you have linked the bank account with the app and it is a one-time exercise. After doing this you can enjoy all the benefits offered by this feature as discussed above.

Conclusion

Thus with the help of this feature, you can stay assured about collecting payment and maintaining all transactions online. Payment can be received via any of the following UPI apps namely Phone Pe, BHIM, Google Pay, Paytm, Bharat Pe, etc using this Fintech app. Link bank account and stop bothering to remember the password, or providing a swipe machine to allow customers for a cashless transaction.