Is the GST Composition Scheme a boon or a bane? This was the subject of a raging debate when the scheme arrived and the debated hasn’t abated.

But, to be fair, the GST council is working round the clock to make it more beneficial to businesses – so that the scheme brings the intended smiles on their faces.

So What Is The GST Composition Scheme

Under the composition scheme, there are specific provisions in the GST framework. The main intention is to bring down the weight of compliance that falls upon the small taxpayers’ shoulders. As per estimates, it is expected that close to 8 million taxpayers will move to GST, though it’s quite possible that many of these businesspersons will have small turnovers, and they will also lack the wherewithal to understand and implement the procedures, as required by the GST regime.

This is where the benefits of the GST Composition Scheme become obvious.

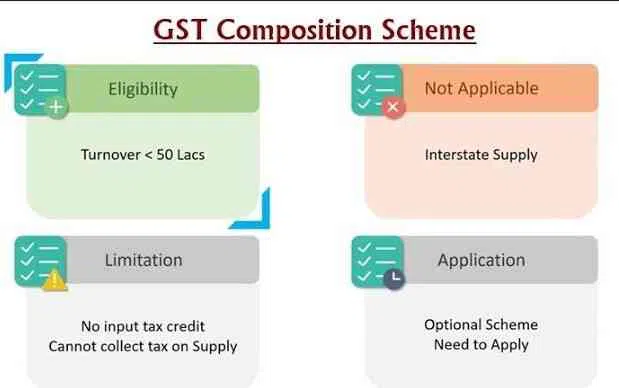

It is simple and easy to understand the benefits of GST for the taxpayers. This scheme eliminates the tiresome and complicated tax formalities and enables taxpayers to pay taxes at a pre-decided rate of turnover. If you are a taxpayer with a turnover of less than Rs 1.5 Crores (Rs 75 Lakhs for North-Eastern states), then you can go for GST registration under the composition scheme.

There is a catch, though – you will not be able to issue a tax invoice, nor will you be able to make use of the credit of the resultant input tax that you have paid. Also, you will be ineligible for this scheme if your business involves inter-state supplies, or if you are a manufacturer of ice cream or tobacco products. Crude petroleum, high-speed diesel, motor spirit, natural gas, aviation turbine fuel and alcohol for human composition are also not eligible products under this scheme.

Service providers can also come under this scheme and reap the benefits of GST composition. The eligibility condition is that the provider has to have a turnover of Rs 50 Lakhs.

The tax rates applicable are as follows:

- For manufacturers & traders – 1% of turnover (0.5% Central GST + 0.5% State GST)

- For restaurants (without alcohol license) - 5% of turnover (2.5% Central GST + 2.5% State GST)

- For other service providers – 6% of turnover (3% Central GST + 3% State GST)

The taxpayers have to pay this tax themselves. They won’t be able to shift this burden on to the end customers.

The idea behind this scheme is taxpayers who are willing to be compliant, can do so without worrying about how tough or how costly it is to be compliant.

Necessary Conditions To Avail Of Composition Scheme

- GST registration is compulsory

- The taxpayer can’t be an NRI or a casual taxable individual

- The taxpayer won’t be able to supply goods exempted from GST

- If the taxpayer has a bouquet of businesses (e.g. textiles, groceries, eateries etc) under the same PAN, then he/she has to register all these businesses collectively under this scheme; else, he/she has to move out of the scheme

- The taxpayer will have to mention “composition taxable person” clearly on every signboard or other types of boards that are on display at their business location/locations.

The Importance of the GST Composition Scheme

The National Sample Survey (NSS) report states that there are more than 60 million Micro, Small & Medium Sector Enterprises (MSME) in India, who employ more than 100 million people. They also contribute more than 25% of India’s economic output.

We can’t overemphasize the importance of this sector. So, the composition scheme has proceeded to provide some relief to this sector with respect to GST filings, procedures, etc.

Towards the end of 2018, there were close to 18 lakhs composition dealers – almost 17% of registered taxpayers under GST. And this number will rise with a higher threshold of Rs 1.5 crores, and with service providers also coming under the net.

In this scheme, the taxpayers have the facility to do away with monthly returns. They can file only one return, viz. GSTR-4 every quarter, by the 18th of the month after the quarter ends. They have to file an annual return, viz. GSTR-9A, by 31st December of the succeeding financial year. These dealers also do not need to keep detailed records.

If you are an end customer, and the seller’s invoice mentions that he/she has chosen to go for this scheme, then you need not pay GST on these transactions.

The Benefits Of GST Composition Scheme

Lesser compliance formality

This is among the most attractive benefits of this scheme. The time and cost involved in filing the returns under Composition Scheme are much less, compared to that in a normal GST scenario. Taxpayers under this scheme need to file 5 returns in total – 1 each per quarter (form GSTR-4) x 4 quarters, plus 1 annual return (form GSTR-9A).

Less Tax

Another important advantage for taxpayers under this scheme is lower tax rates. This has a linked benefit – that of higher liquidity. A businessperson will utilize a lesser amount of his/her working capital for tax payment, thereby having more funds for the expansion and development of the business.

Encouragement to startups

Startups are often hard-pressed for cash. With the low tax rates for businesses with turnovers of less than Rs 1.5 crores, startups will now feel encouraged to prosper – generating more livelihoods.

Equal opportunity generator

The profit margin of businesses under the Composition Scheme will be more than large businesses as the former will pay lower taxes. This allows small businesses to fight the economies of scale that large businesses enjoy – by making their products competitively priced. This also ensures that the smaller, intrastate businesses have a tighter hold on the local markets.

Conclusion

To conclude, it is quite evident that the benefits of the GST Composition Scheme make it a boon for small businesses, as it acts as a positive catalyst for growth. There might be some minor disadvantages, too, as it happens with every scheme. But regular monitoring & feedback from businesses can minimize those drawbacks – thus creating a business-friendly & growth-inducing tax regime.