You frequently talk about your target pay in the hiring process or write it down on a resume. And we realise the anxiety that comes with this—you would not want to offer a small monetary response and have to accept lesser pay than you deserve. However, you do not want to appear to have unrealistically higher expectations. It's critical to understand how to respond to this topic. Giving a desired pay in the suitable range can assist you in obtaining a position that will adequately recompense you for your talents and expertise.

Did you know?

You may immediately scare them away if you say too high a figure. Furthermore, providing an unrealistically low desired salary can limit your potential to negotiate later.

Let us first look into what is desired salary meaning? The sum of money you want to earn in your new work one can refer to as the target wage. This is also the sum of money you should earn in your new work, depending on your degree of qualifications and expertise. Whenever a prospective employer poses this question, they're looking for an authentic, practical response—but offering your response prematurely could hinder your likelihood of getting what you deserve. Let's start with how to calculate your genuine desired pay.

How to Determine Desired Salary?

You must have an exact figure in mind before you could even consider delivering a definite solution to this question around a resume or in an interview—even when you don't divulge it straight away. This is especially true when discussing certifications, such as passing the CompTIA SY0-701 Dumps, which can significantly impact your earning potential. This is especially true when discussing certifications, such as passing the CompTIA Security Exam, which can significantly impact your earning potential. One must understand what you want to achieve so you may be confident throughout the wage proposals you accept or reject. But, because we know how tough it may be to agree on a value or bracket, below are some variables to consider:

Also Read: What is the Meaning of Salary Structure?

-

Do Some Research

A fast Internet search can eventually show the sector compensation norms for the target position. Many job-hunting services will also allow you to look for norms in your geographical region. Salary bands might vary depending on the state or location, and the compensation scale effects by the dimension of the organisation and its degree of achievement. Another option to find out about salary is to question other workers in comparable positions, but please remember that it is sensitive details that not everybody is confident in revealing. You may also request any consultants in the industry (who aren't affiliated with the firm you're going to) to provide the average salary you have seen for the sort of employment you're seeking.

-

Account For Your Skill Level and Experience

Many people firmly believe that one doesn’t need a 4-year degree to receive a good job. However, as per the position requirement, many firms will always evaluate qualifications and training. Additional years of expertise in a certain sector usually translate to greater remuneration. So, even though you may not have a lot of schooling but still have years of expertise in positions similar to the one you desire currently, your salary will match that.

Another factor to take into account is your level of expertise. Entrance-level talent will earn you less money than high-level skills. However, skillset does not always equate to time one spent functioning in a sector; many individuals finish college with a better degree of skill than someone who has been previously working in the profession for a certain period. Be truthful to yourself about the skillset, and then if you feel you have a competitive advantage, add that into your payment estimate.

-

Think About Your Cost of Living

This is an important concern, particularly when you have a family to support. How much money would you require to earn to cover the whole of your family's (or perhaps even your individual) expenditures? What kind of income do you require to live a decent life? How much income do you require to repay a loan, save for a home or vehicle, or contribute to your child's education financing? Would you have to transfer when you took a specific job? After all, everyone is required to budget and live within their limits to the greatest extent, but one thing is for sure: no doubt your earnings can either create or break the path of reaching your financial targets.

-

Take a Look at the Benefits Being Offered

Medical insurance, full pay leave, and more possibilities can all play a role in determining your ideal pay. Perhaps you'd like to earn ₹85K every year, and you're searching for a position that pays a bit less and still gives you limitless PTO (yeah, that's a genuine condition at certain companies). You could be willing to reduce your target wage in exchange for that advantage. Perhaps you're considering a firm that pays your ideal salary but does not provide you with a medical insurance plan. It may be a problem for you!

After you consider all of these considerations, agree on the agreement pay—that is, what is the lowest acceptable wage you'd take before actually turning down the job proposal? It may not have to be similar to the pay you seek. It's your choice to decide whether you will already determine on one figure or are willing to do the job within a pay range, and therefore only you can realise what's best for yourself.

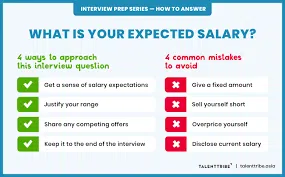

How to Answer “What Is Your Desired Salary”?

Now that you've decided on your ideal pay, the next phase is to be firm whenever they ask you about it! Below are two instances in which you may require to face this question and the best methods to respond.

-

On a Job Application

As we previously said, it's best not to divulge your ideal compensation too soon in the recruiting process since it might restrict your options if the firm is willing to offer more. Because not all forms may inquire about your ideal income, there's no requirement to provide it if they do not want it. When they inquire, say anything straightforward like "pay is flexible" or "You will discuss pay in the interview session."

-

In Interviews

Because interviews could be nerve-wracking, it's a smart option to plan your response ahead of schedule. Remember that there is no force to provide a specific figure, and you needn't feel it necessary to do so in case you're not comfortable. There are numerous polite and courteous responses to this inquiry that do not require you to give a precise financial sum. This is where practicing with an AI mock interview tool becomes valuable, as it helps you rehearse anchoring salary expectations in a way that feels natural and professional.

Example Responses

- I do not have a precise figure in mind. However, I'd anticipate that you will pay what you believe is reasonable considering the company standard and my degree of expertise.

- I do not really have a certain figure in mind. How much allotment have you kept aside for this role?

- My highest focus is to seek employment that matches my level of expertise and is at a firm that I care for. As we progress through the interviewing process, I'm willing to discuss the pay you believe is appropriate.

- I normally don't talk about money until the company offers the job. Can it be okay that we finish the hiring process to check if I am the best person for this role before talking about compensation?

- My ideal pay range on the resume was ₹80–90K, and now after more research, I think that ₹90K will be a reasonable pay to negotiate for, considering the position's demands, my depth of expertise, and the reality that I will have to relocate.

Also Read: How to Negotiate Salary After You Get a Job Offer?

Tips for Discussing Your Desired Salary

-

Confidence Without Cockiness

Among the most difficult rope bridges to tread throughout an interview seems confident without striking across as condescending. Regrettably, if you appear hesitant, the recruiting manager may take advantage of this to attempt to settle a lesser compensation.

-

Go Broad

Whenever in doubt, if you can arrive with a fair band of incomes that you consider appropriate, go broad and place your dream pay below that band. Offering a compensation band with your desired pay close to the base allows both sides to negotiate and increases the likelihood of you receiving the income you desire.

Conclusion

There are numerous methods to discuss your ideal wage without confining yourself. When combined with a deep belief in whatever you want and require, integrity will always go very far. Now we hope that this question is no more frightening.

Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.