It doesn’t matter if we are on the receiving end or the paying end; we must be aware of the employee compensation structure that is appropriate for an organisation or, the other way round, fit to pay for the services provided by an employee. Compensation meaning may vary from organisation to organisation depending on the company policies. However, certain compensation laws must be retained while paying out an employee. This article is intended for everyone who wants to understand the compensation meaning, the different types of compensation involved within an organisational flow, and the rules and regulations that must be met while structuring employee compensation.

Did you know?

Wage and Hour Law, Minimum Wage Law, Equal Pay Act, and certain components of Civil Rights Law are all covered by compensation rules.

What Does Compensation Mean?

As the initial step to understanding the compensation meaning, we need to answer the question of what is compensation for an employee. Employees of any organisation are awarded a regular paycheck for their service. However, it is not only the steady paycheck that is paid to them. There are other wages paid to them, as well. Now, the question is, do these wages come under the category of compensation? This could be understood in detail by this blog which appropriately answers the question of the meaning of compensation.

Employee Compensation Definition

Starting with compensation meaning, compensation is the total cash and non-cash payments made to an employee in a financial cycle in exchange for their contributions to the organisation. These contributions might include the time, skills, knowledge, abilities, and commitment an employee invests in a company or any particular project.

Employee compensation is the largest expense that a company makes. Other than the paycheck, other wages compensate the employee's services. Thus, you will find different types of compensation functional within an organisational flow. Here is the list of types of compensation for better know-how of compensation definition.

- Base pay paid hourly or salary wages,

- Sales commission depending on the number of sales,

- Overtime wages paid on shift differentials

- Tip income depends on performance,

- Bonus pay paid occasionally,

- Recognition or merit pay,

- Benefits come in the forms of insurance, standard vacation policy, retirement,

- Stock options as a variable source of earnings,

- Benefits such as travel, meal and housing allowances,

- Certain employee assistance programs include counselling, legal advice, and other services.

- Health and wellness benefit the employee and the family to a certain extent.

- Other non-cash benefits.

Also Read: How to Answer What Are Your Salary Expectations?

About Base Pay And How Does It Differ From Total Compensation

The base pay is the initial amount that an employee is paid. The minimum amount the organisation pays the employee before taxes and other deductions comes into the scenario. The base pay is the fixed amount bound to be provided by the company to the employee, which cannot be denied or changed under any circumstances.

Base pay includes the base salary, shift differentials, and special pay-outs but does not cover other benefits like bonuses, overtime, commissions, etc. It does not cover any compensation that raises the bar of the minimum base pay.

All the above mentioned different types of compensation are included in total compensation. Total compensation means that it is the base salary plus all the company's other benefits.

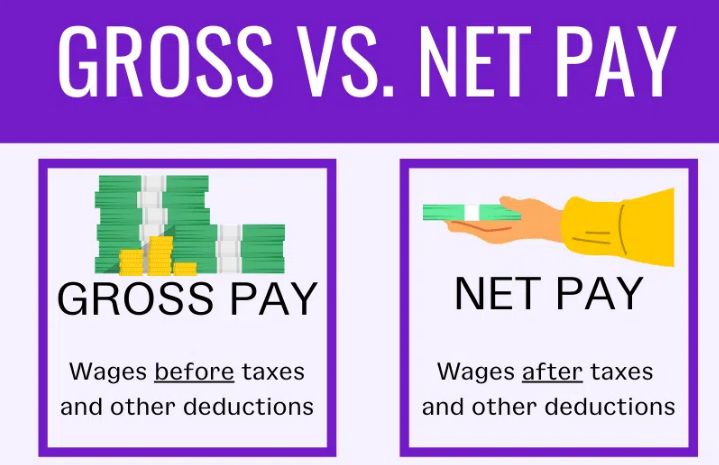

Gross Pay And Net Pay, Is One Of Them A Base Pay?

While gross pay is the total compensation promised to the employee before the taxes and other deductions are applied to the salary structure. Net pay is the actual take-home amount for the employee after all the deductions are made.

So, base employee compensation constitutes both gross and net pay, but other compensations might come with gross or net pay. These compensations might include overtime wages, home allowances, etc. Thus, it can be said that the base pay might be gross pay when no other compensation is attached to it.

How To Determine The Compensation Of Employees

There are several ways to design a compensation plan that suits the business. It must be designed so that the company can attract and retain valuable talents for the organisation through it. Compensation meaning lies in the fact that employee satisfaction can only lead an organisation to its zenith. And, employees will only be satisfied with a good compensation plan.

The plan must also not overlook the benefits of the organisation. Assuring internal equity must be the prime motto of the compensation plan. Here are some points for you to consider while determining employee compensation and retaining company internal equity.

Develop Compensation Philosophy

Before you start designing an employee compensation structure, developing a compensation philosophy that goes well with the company's vision and mission might prove beneficial. It will help in creating a suitable compensation structure and retaining company benefits. It must include base pay as the primary objective and other compensations you would like to offer your employees. Other compensations like commissions, bonuses, overtime, incentives, and others can be included.

Do Research On Competitors

When you compare your organisational compensation policies with your competitors, you might discover whether you are on the right path or not. You must check what other companies pay for the same job title and role as an employee. An easy way to check this is to check the websites where employees leave comments and self-report on their compensations.

Performance-Based Compensation

As a company, when your employees are doing well or are showing high performances, you must ensure compensation right away. Reward them with a salary hike or recognition or merit pay.

Previous Salary Or Wages

Do a check on the employee’s previous wages. You can structure your payout according to that, like offering an increased salary or extra attractive benefits.

Annual Pay Hike

This is almost a mandate for most organisations. Employees are the building units of any organisation and thus must be properly taken care of. Ensuring an annual salary hike will only help you retain employee loyalty and thus increase productivity.

Plan Your Budget

No company will survive without a proper budget plan. Check for the availability of company funds and identify the amount you can spend on employee compensation. Before you offer compensation to your employees, be sure how much your company funds can afford and what is the real valuation of the resource.

Offer Attractive Benefits

You can lower the base pay by offering good benefits, making it a cost-effective compensation plan. Just learn what kind of benefits would suit the positions and attract considerable talents at lower base pay.

Compensation Regulations

Before you decide that you have got the compensation meaning and proceed to set on employee compensation, you must check for the rules and regulations that the federal law looks after compensation policies. Several local, state, and federal bodies ensure no manhandling of the employees by the employers through these compensation laws. These government-approved rules and regulations handle various types of compensation to administer employee compensation. Some of the rules are,

Wage And Hour Law

This law comes under the FLSA or Fair Labour Standard Act which regulates employee status, minimum wages, child labour, overtime eligibility, overtime pay, record keeping, and other administrative aspects concerned with wages.

Also Read: What is Deferred Compensation and How Does it Work?

Minimum Wage Law

States that no employee can be paid below the minimum wage standards and comes under FLSA.

Equal Pay Act

This act ensures that no employee compensation can be determined based on gender and that all employees carrying the same position must be paid equally irrespective of their genders.

Law For Civil Rights

This law forbids companies to compensate employees based on colour, sex, race, religion, or nationalities.

Again, it is important to know about tax laws before setting compensations. Each type of compensation comes with a different set of tax laws. So, make sure that you know about them before awarding compensation to an employee.

Conclusion

Knowing about compensation is important when you are running an organisation and are responsible for paying compensation to several employees. There are different types of compensation that you must know and understand before you determine employee compensation. Now that you know what is compensation and have gained knowledge on how to set an employee compensation structure, it is time that you are well aware of the federal rules and regulations that are there to protect employee compensation interests.

Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.