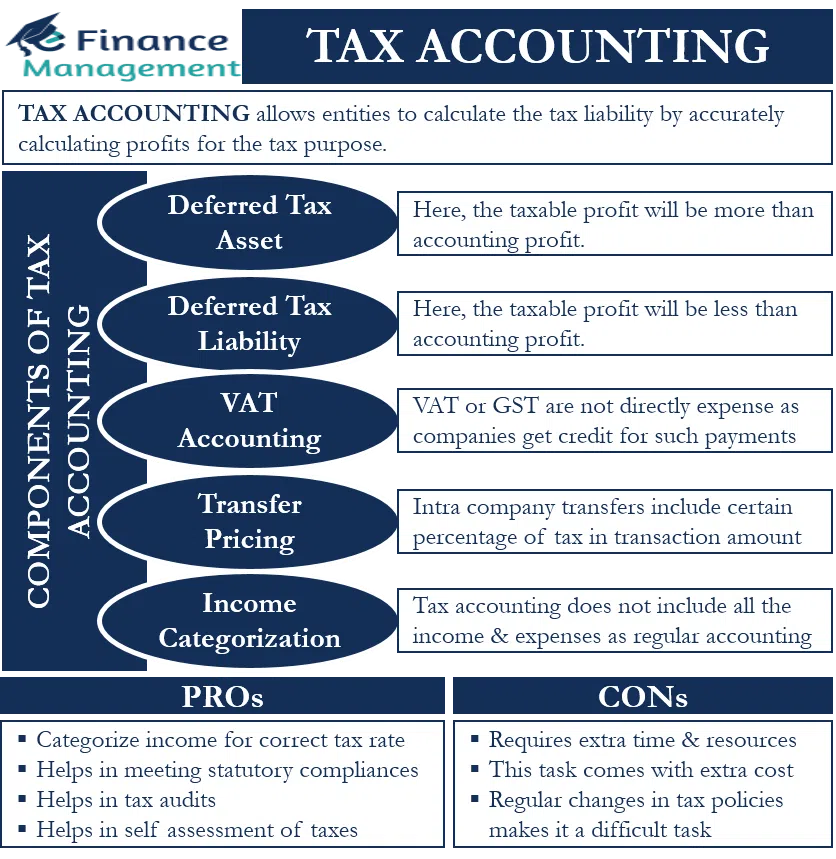

Accounting for taxes refers to a collection of accounting information that is more concerned with the calculation and reporting of taxes than they are with the display of public financial statements.

When it comes to submitting tax returns, both individuals and corporations must adhere to specific procedures outlined in the Revenue Code. This code also serves to control tax accounting standards.

Keeping financial records for the government's use is known as tax accounting. People on an individual level, and organisations, corporations, and other institutions could be impacted. Even though they may not be obligated to pay taxes, even those individuals are still required to participate in the accounting process. Tax accounting is designed to make it possible to keep tabs on the money that is associated with enterprises and individuals (both incoming and outgoing).

Did You Know?

Tax accounting is a subsector of accounting that focuses on preparing tax returns and the payment of tax obligations. Tax accounting is more difficult for businesses because of the increased scrutiny placed on the use of funds and determining what is and is not taxable income.

Also Read: Tax Liability Meaning, Types & Learn How to Calculate Tax Liability

Also Read: Tax Liability Meaning, Types & Learn How to Calculate Tax Liability

What is Tax Accounting?

The framework of accounting systems known as tax accounting is primarily concerned with taxes rather than the outward presentation of financial accounts to the public. Accounting for taxes is managed by the Internal Revenue Code, which outlines the particular standards that businesses and individuals are required to adhere to while completing their tax returns. This code also governs accounting for taxes. Accounting for taxes refers to the process of keeping financial records for use in tax preparation. It applies to all types of entities, including individuals, enterprises, and corporations, among other types. Even people who are exempt from paying taxes must participate in the accounting process for taxes. Accounting for taxes is done to keep tabs on the flow of money associated with individuals and companies, both in the form of incoming and outgoing cash and is done by the taxation accountant.

Meaning of Tax Accounting

Accounting for income tax is necessary to determine taxable profit and the amount of tax that must be paid. This is accomplished by changing the book profit that was determined using accounting principles. These statements are preserved for tax audit purposes, and all of these workings and adjustments are included in the tax return as part of the return itself.

Instead of focusing on preparing public financial statements, tax accounting is primarily concerned with the preparation of tax returns for companies and the management of payments. In the United Kingdom, the type of tax return for which you are liable will be determined by the size and structure of your company and whether or not you are required to register for VAT.

When calculating your company's taxable income, tax accounting considers the revenue from your business and any deductions and government credits for which you could be qualified. Because of this, the income recorded on the income statement may not necessarily be the same as the income subject to taxation. Income subject to tax is subject to the most recent regulations issued by HMRC, which are subject to change from one year to the next.

It is simple to open a company tax account with HMRC and take care of these payments independently. This option is available to individuals who work for themselves and smaller firms. On the other hand, due to the increased complexity of the returns and the requirements for reporting, larger organisations may find it necessary to retain the services of a corporate tax accountant.

Financial Accounting Principles vs Tax Accounting (GAAP)

Two different standards are used in accounting in the United States. Accounting for taxes is regarded as coming first, followed by financial accounting, also known as generally accepted accounting principles, which comes in second (GAAP).

Organisations must adopt a standardised set of accounting information and principles, regulations, and processes to properly compile financial accounts and account for any financial transactions. When the financial matters and the tax obligations are accounted for in several different ways. The FIFO method, for instance, can be utilised by businesses to compile financial statements. Maintain stock records for financial purposes while using the LIFO accounting method for tax calculations. The second method brings about a reduction in the total amount of taxes owed for this year.

Only transactions that impact an entity's tax burden or pressure are considered relevant to accounting to ensure accurate calculation and production of taxes. The Internal Revenue Service (IRS) is in charge of regulating tax accounting to ensure that individual taxpayers, as well as tax accountants, comply with all tax rules that are currently in effect. To present the information regarding taxes accurately and truthfully, as is required by the law, it is necessary to have the required papers and forms.

Also Read: Minimum Alternative Tax (MAT) Explained in Detail

Various Types of Tax Accounting

Tax accounting can be classified into various types. There are 3 main types, and they are as follows:

-

Individual Financial Accounting

Individual taxpayers' tax accounting is only concerned with items like income, eligible deductions, investment gains or losses, and other activities that affect their tax burden. This reduces the amount of information required for an individual to manage a yearly tax return, and while hiring a tax accountant is an option, it is not required by law.

Meanwhile, general accounting would entail keeping track of all funds entering and exiting a person's possession, regardless of their intended use, including personal expenses that are not tax-deductible.

-

Accounting for Taxes in a Business

More information must be reviewed as part of the tax accounting process from a business standpoint. While the company's revenues, or entering cash, must be tracked in the same way an individual must, any exiting monies directed toward specified corporate commitments add a layer of complexity. This can comprise funds earmarked for specific business needs and funds dedicated to shareholders.

While a company doesn't need to hire a tax accountant to handle these tasks, it is very frequent in larger companies due to the complexity of the data. Many modern businesses are also turning to automated tax compliance solutions like Numeral to streamline their sales tax processes and reduce manual workload.

-

A Tax-Exempt Organization's Tax Accounting

Even if an organisation is tax-exempt, tax accounting is still required, and this is because most businesses are required to file annual reports.

They must disclose any incoming finances, such as grants or gifts, and how the funds are spent during the organisation's operation. This ensures that the organisation follows all applicable laws and regulations governing the appropriate running of a tax-exempt organisation.

Conclusion

The Revenue Code helps govern tax accounting, setting out the particular procedures businesses and individuals must follow when filing tax returns. Creating and planning a budget can help a company save money, develop strategy, and keep spending under control. A business needs numerous financial documents to create a budget, and accounting keeps accurate records of financial statements, which helps develop a fixed budget. Individuals who enjoy working with statistics, solving issues, and accepting challenges are generally drawn to tax accountant professions. Tax accountants are responsible for more than just preparing tax returns.

Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.