Every country wants to improve the lives of its people. In a highly populated country like India, this is a great challenge. Though predominantly an agriculture-based economy during independence, our visionary leaders recognized the need for simultaneous industrial development. This meant that a large workforce had to be generated and sustained. One major challenge faced by workers and their families was health.

Medical expenses, and costly treatment, were unaffordable. Hence, the Government of India set up a framework where the employee, employer and the Government would join hands and solve this problem. The concept of ESI was born.

Did You Know? As of 2019, ESI had covered over 8 lakh factories spread across over 700 locations, protecting about 2.5 crore people under its umbrella. Today, the numbers are much more.

What Does ESI Mean?

Employees State Insurance (ESI) is a social insurance created by the Government of India. It intends to help employees and their families on matters related to sickness, injury and even death.

History of ESI

The Parliament enacted the Employees State Insurance Act, in 1948. ESIC – Employee State Insurance Scheme – was first inaugurated by Prime Minister Pandit Jawaharlal Nehru in Kanpur in February 1952. It was also launched at the same time in Delhi. Thus, there were only two ESICs when it all started. Because of the genuine benefits of the Scheme, it is today a mammoth organization trusted by everyone.

Who Does ESI Cover?

ESI covers every eligible employee and family member. The coverage includes full medical care. ESIC also provides financial support to compensate for the loss of wages during work absence. Sickness, maternity, and injury during work are covered in the Scheme.

Also Read: Guide on How to Calculate PF on Salary? Steps to Calculate the EPF Amount

Who Manages ESI?

All operations of the ESI Scheme are handled by a statutory body called the Employees’ State Insurance Corporation (ESIC). The Corporation has a top management team drawn from employers, employees, representatives of Central and State Governments, medical professionals and a few chosen Members of Parliament. A senior Secretary of the Ministry of Labour is nominated as the Chief Executive Officer of ESIC.

ESIC is administered at the national level by a Standing Committee. A Medical Benefits Council guides the Standing Committee on medical aspects of ESIC’s policy-making and implementation.

At the State level, Regional Boards and Local Committees, Hospital Development Committees are formed to ensure quality.

Who Is Eligible For ESI Coverage?

Every employee whose gross salary is ₹21,000 or below is eligible to be covered under ESI. It covers the employee’s family also. For disabled employees, the gross salary limit is ₹25,000.

The insurance coverage commences from the very day the employee joins the company.

Who Should Register With ESI?

Any firm that has 10 employees or more has to register with ESI. This is mandatory. However, a few States have set 20 employees as the lower limit. Firms in the following categories are covered by ESI:

Every factory that has 10 or more employees must register with ESI. Additionally, as per GOI issued under Section 1(5) of the ESI Act, the following categories are also covered under ESI:

1. Shops & Establishments

2. Cinemas and Theatres

3. Cafes, Restaurants and Hotels

4. Cargo and Logistics Firms

5. Newspaper establishments

6. Private educational institutions, irrespective of ownership

7. Since 2015, construction labour is also covered under the ESI Scheme

Also Read: ESI Calculation - How is ESI Computed?

How To Register With ESI?

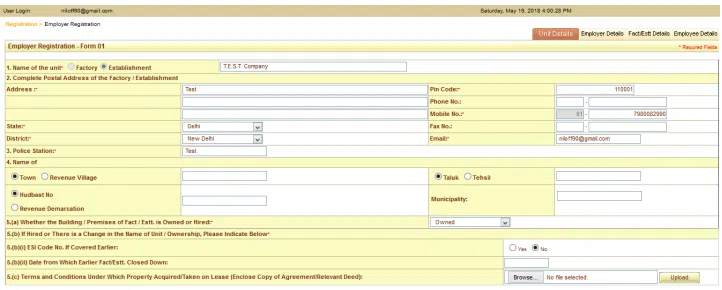

Registration with ESI by Employers is simple and done online. The steps are:

- Visit https://www.esic.nic.in

- Sign up your organisation in the “Employers Portal” in the “Services” menu.

- Fill in your organisation’s details and click on “Submit”.

- You will receive an acknowledgement with login details.

- Log in and sign up for “New Employer Registration” and fill in all details asked for.

- Follow the screen and provide accurate information as needed.

- Once done, “SAVE” the application.

- Next, add employees who are to be registered with ESI as per their eligibility.

- Select “SAVE” and “Close”.

- Browse and select the ESI Branch under whose jurisdiction your organization is covered.

- After all the above is done, select “Submit”.

This will be followed by payment of advance contribution. Once payment is remitted online, a receipt will be emailed to you, and your ESI account will be activated.

Funding of ESI Scheme

The ESI Scheme is financed mainly by contributions from employers and employees. The rate of contribution by the employer is 4.75% of the wages payable to employees. There is one more important point to be noted. The Government always wants to encourage employers to engage persons with disabilities.

Whenever an employer engages persons with disabilities, the Employer is fully exempted from the Employer’s Contribution. The Ministry of Social Welfare bears this cost and pays it to the ESI. This is an incentive for employers to support a social cause.

Also Read: How to Make ESIC Payment Online and Its Deadline

Documentation Required

The following documents are to be submitted during registration with ESIC.

- Registration Certificate of the organization. (Shops and Establishments Act, Factories Act etc., as applicable).

- Partnership Deed, Memorandum and Articles of Association, Trust Deed as applicable.

- For Factories, factory registration and a Certificate of Commencement of Production are required.

- Full details of employees and their salaries.

- Full details of the Management – Owner, Partners, Directors, and Trustees.

- PAN Card and Address proof

- Bank Statement

Rules For ESI Return Filing

The employer has to file a monthly contribution statement declaring details of employees for whom the amount is to be remitted. This is done online.

Contributions must be remitted to the bank nominated by ESIC within fifteen days from the end of the preceding month. Delay will attract penal action from the ESIC.

As per the rules for ESI Return Filing by the ESIC, every registered organization must file returns once every six months. The deadlines for filing the Return are 12th May and 11th November of every year.

Procedure For ESI Return Filing

The employer must first log on to www.esic.nic.in using credentials already provided during registration and follow these steps:

- Verify all details displayed.

- Edit or Add details of any new inputs like accidents, injuries etc.

- Update all details.

- Remit the payment.

- Generate Challan.

- Repeat this every month.

Mandatory Records to be Maintained for ESI Return Filing

The following records must be maintained by every organization registered with ESIC.

1. Attendance Register

2. Wages Register

3. Form-6 Register

4. Accident Register

5. Inspection Book

6. File containing all monthly challans & returns submitted

Exemption From ESI Registration

If a company can prove that they provide benefits superior to what ESI provides, it can obtain an exemption from registration under ESI. The exemption is given for one year at a time and must be renewed every year at least three months before the expiry of the current permission.

Penalties For Failure to comply with ESI Return Filing

Failure to comply with ESI Return Filing is a serious offence. If an establishment fails to file the ESI Return, it will be fined up to ₹5,000 and liable for imprisonment, extending to 2 years. This is covered under Section 85 of the Employees State Insurance Act, 1948.

Even delay in ESI Return Filing is not accepted. In case of any delay, ESI is empowered to levy a penalty of 5% to 25%. Apart from this, ESIC will also charge interest at 12% for the delay period.

The following slab is followed for calculating the Rate of Damages:

Benefits of ESI

ESI benefits are described in detail in Section 46 of the Act. They are as follows:

1. Medical Benefits

This covers the medical treatment of the employee and family members. These are usually available at ESI Dispensaries, Outpatient Wards at ESI Hospitals, and approved Diagnostic Centres. It also includes special aids like artificial limbs, free lab tests, free medicines, free ambulances and so on.

2. Sickness Benefits

If an employee falls very sick and cannot attend work, the employee can avail of this benefit. This is available for a maximum of 91 days in a year. ESIC pays 70% of the wages during this period. However, the employee must have contributed at least 78 days in the previous 6 months to be eligible for this.

3. Temporary and Permanent Disablement

In the event of an injury to the employee, ESIC will support the employee by paying 90% of the wage till the employee recovers and is fit enough to work.

If the disablement is permanent, ESIC will pay, monthly, 90% of the wages to the employee.

If death occurs during work, ESIC will pay the family of the deceased 90% of the wages every month. Additionally, they will release an amount of ₹15,000 towards funeral expenses.

4. Maternity Benefits

Under this benefit, the woman employee is paid 100% of her wages for 26 weeks. This could be further extended on medical advice.

5. Additional Benefits

In addition to the above specific benefits, several other benefits are also provided by the ESIC. These come under Vocational Benefits and Rehabilitation Benefits.

Also Read: Home Guard Salary - Home Guard Salary Details, Application Process & Benefits

Number of ESI Hospitals and Clinics in India

ESIC is a massive organization. Presently they have 154 full-fledged hospitals, 42 Hospital Annexes, 1570 Dispensaries and 1753 approved Panel Clinics.

To have an idea of the volumes handled, here is the data for September 2022:

Claims Settled:

|

Sickness Benefits: |

66,654 |

|

Maternity Benefits |

15,460 |

|

Permanent Disablement |

1,84,598 |

|

Dependent Benefits: |

96,113 |

|

Number of insured employees: |

467 lakhs |

|

Average employee additions per month: |

17 to 20 lakhs |

|

Number of registered establishments |

18.77 lakhs |

|

Average employer additions per month |

25,000 per month |

Conclusion

All the data sums up the vital contribution the ESI Scheme is making in the lives of Indian employees. It truly reflects the vision of those who started so early after independence. Employers should view meeting such a noble need more as a social cause than a statutory requirement. If the mindset is tuned, there will not be a single default in ESI Return Filing for all times.

Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium businesses (MSMEs), business tips, income tax, GST, salary, and accounting.