Sending money via digital platforms, or electronic money transfers, is a contemporary convenience that makes money transfers simpler, faster, and possible from a distance. When speaking of online methods for transferring money, all you have to do is download the application that supports payments and select your preferred method for sending money from one user to another.

PayPal is an online payment platform and mobile app that facilitates bank transfer with debit card and the exchange of money between parties. Customers using PayPal create an account and link it to a checking or credit card—or both. Users can utilize PayPal as a facilitator to transfer or receive payments online or in-person once identification and proof of money have been verified.

Did You Know Founders and former employees of PayPal are known as 'PayPal Mafia'.

How does PayPal function?

Users must have a credit card, debit card, or bank account in order to set up an account, and they must also have an email address. Before the service may be used, PayPal checks the data to make sure the person opening the account is the legitimate owner. More you can also follow the steps as follows:

- Tap on the 'Sign Up' button.

- Fill in the email address you want to use for the account.

Also Read: What Are the Benefits of Digital Payments Methods for Small Businesses?

- Check your inbox for an email from PayPal requesting confirmation via the link provided.

- Provide PAN details and proceed with KYC questions.

- Now link your debit or credit card.

Can Indians use PayPal?

Since its establishment in the US, PayPal has facilitated the sending, transferring, paying, and receiving of money by people, businesses, and independent contractors. Currently in India, PayPal does not support any kind of personal payments to friends or family members. PayPal's features aren't fully accessible in India. And at the present, Indian citizens are unable to use one of the most crucial features—adding money to a PayPal wallet or balance. You can access the PayPal worldwide shopping mall in India and make purchases from brands on the PayPal platform.

How to add money to a PayPal India account?

To add money to PayPal wallet India, click on 'Payment Methods' and ensure your PayPal account and your bank account are linked or a debit or credit card that can be used to make a transaction via the PayPal payment gateway may also be linked to your PayPal account.

How can I transfer money from PayPal to my bank account?

It's nice to have a protected PayPal wallet, but how can you quickly and easily transfer money to your bank account? Follow these simple steps:

Browser

Also Read: How to Get UPI QR Code for your Flourishing Business?

Link a Bank Account or Eligible Debit Card

To start receiving money using PayPal, you don't need to have a debit card or bank account linked to it. However, by linking your account to your PayPal wallet, you can get more money and transfer funds to your bank account. In order to allow money to move easily between your accounts, PayPal will invite you to set up a direct debit order with your bank account.

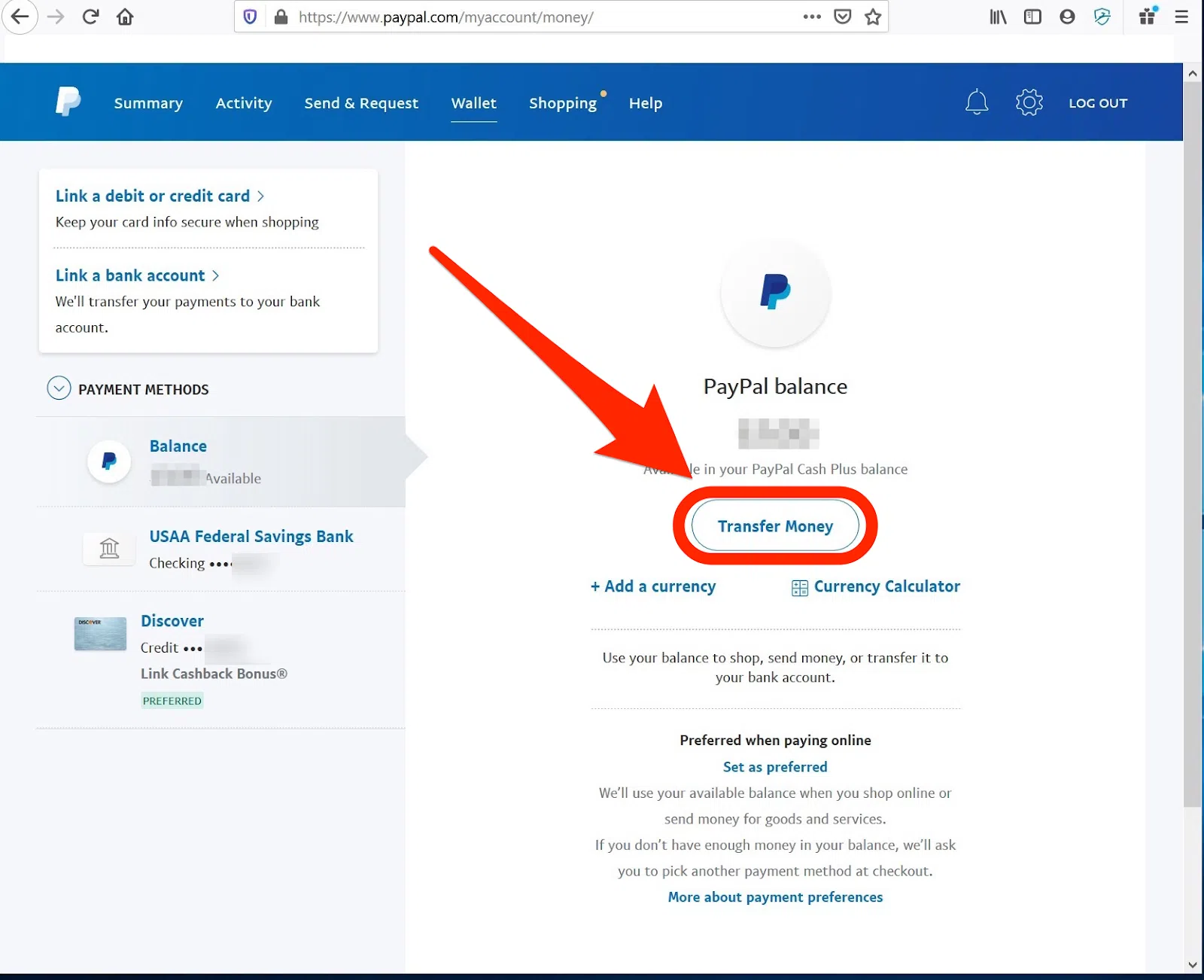

To start your transfer, go to your PayPal wallet

Click 'Pay and Get Paid' and from the dropdown menu, pick 'Transfer Money.'

Select Your Transfer Method

When you click 'Transfer Money', you'll see a list of available bank accounts and credit cards to which you can send your cash withdrawal. You will also have the option of performing an instant or standard transfer.

Also Read: What are Debit, Credit Note and their Formats?

Enter the Amount You Want to Send

After selecting the account to which you want to transfer funds, enter the amount to be transferred. If the money in your account is currently in a foreign currency, there will be an additional cost in addition to the exchange rates. The average currency conversion fee is 1.5%. The screen will display the amount you will receive in your local currency in your bank account.

Check your transfer details twice

The final screen will show you:

- The amount you are transferring to your account

- Any transfer fees

- The final amount that will reach your account

- Which eligible bank you are sending your money to

If it all looks good, click 'Transfer Now' to begin the process. If not, you still have time to fix any mistakes by clicking 'Back'.

How to set up automatic transfer with PayPal?

If you'd rather have your funds transferred to a bank account automatically, follow these steps:

- Link your bank account to your PayPal account.

- When you sign in, you'll be in the Money, Banks, and Cards section, where you can turn on Automatic Transfers.

- Choose the bank account to which you want your funds transferred.

- Now any payment will directly be received in your bank account within 2 business days.

Can I exercise bank transfer with a debit card using PayPal?

Individual purchases on PayPal do not require a bank account. It is necessary to have a valid debit or credit card. But in case of transfer of funds from one bank account to the other (electronic fund transfer), linking your account to your PayPal wallet is mandatory.

Conclusion

PayPal is accepted by millions of small and major retailers both online and offline. Moreover, PayPal provides debit and credit cards bearing the PayPal name. In the world of online payment processing, PayPal commands a global market share of 31.74%. One of the most popular payment processors in use today is PayPal. It has 203 million active users and is accessible in 202 countries. Currently, 770,793 websites accept payments using PayPal, and this number is increasing daily.

Follow Khatabook for the latest updates, news blogs, and articles related to micro, small and medium enterprises (MSMEs), business tips, income tax, GST, salary, and accounting.